Sales Tax Rate For Dallas Tx – Yet, at the same time, there’s the promise of new beginnings for both the seller and the buyer. From the most trivial items in a dollar store to the most precious works of art in a museum, everything can be assigned a price. Second-hand goods for sale are no longer seen as inferior or out-of-date, but rather as a conscious, stylish, and eco-friendly choice. These platforms allow buyers to browse listings, access detailed business profiles, and initiate contact with sellers, all from the comfort of their own home. This has opened up new possibilities for people to find exactly what they’re looking for, whether it’s a specific brand of furniture or a limited edition item that was once sold out. The closing process also involves transferring the business’s assets, such as inventory, property, intellectual property, and customer contracts, to the new owner. There’s a certain art to selling something. For sellers, this creates an opportunity to declutter their homes and make some extra money, while buyers have access to a vast marketplace of affordable, unique, and sustainable products. Whether through local thrift stores, online marketplaces, or garage sales, the option to buy pre-owned items has created a flourishing market that continues to grow. The internet, for example, has created a space where anyone can buy or sell almost anything, from physical products to intangible services. Similarly, in relationships, individuals may feel as though they are selling themselves, presenting their best qualities and hoping for the best outcome. In a circular economy, items are kept in use for as long as possible, reducing the need for new resources and minimizing environmental harm. This is particularly important in a world where design has become a central element in consumer decision-making. Once a suitable business has been identified, the buyer usually begins the due diligence process, which involves reviewing all relevant documents, financial records, and contracts. For many, purchasing second-hand goods is not only a practical and affordable choice but also an environmentally conscious one. Used bookstores, both physical and online, offer an extensive selection of pre-owned books, from contemporary novels to classic literature. Whether you’re the seller or the buyer, the phrase “for sale” is a reminder that everything in life is in constant motion, always moving toward something new, something different, something better. People can be bought and sold in the form of labor, for example, and loyalty can be traded for material gain. The online second-hand market has also made it possible for people to buy and sell niche items that may not be available in local stores. We live in a society where people constantly trade their time for money, their expertise for compensation, their dreams for tangible rewards.

Texas Sales Tax Permit Calculator Local Rate Lookup_2024

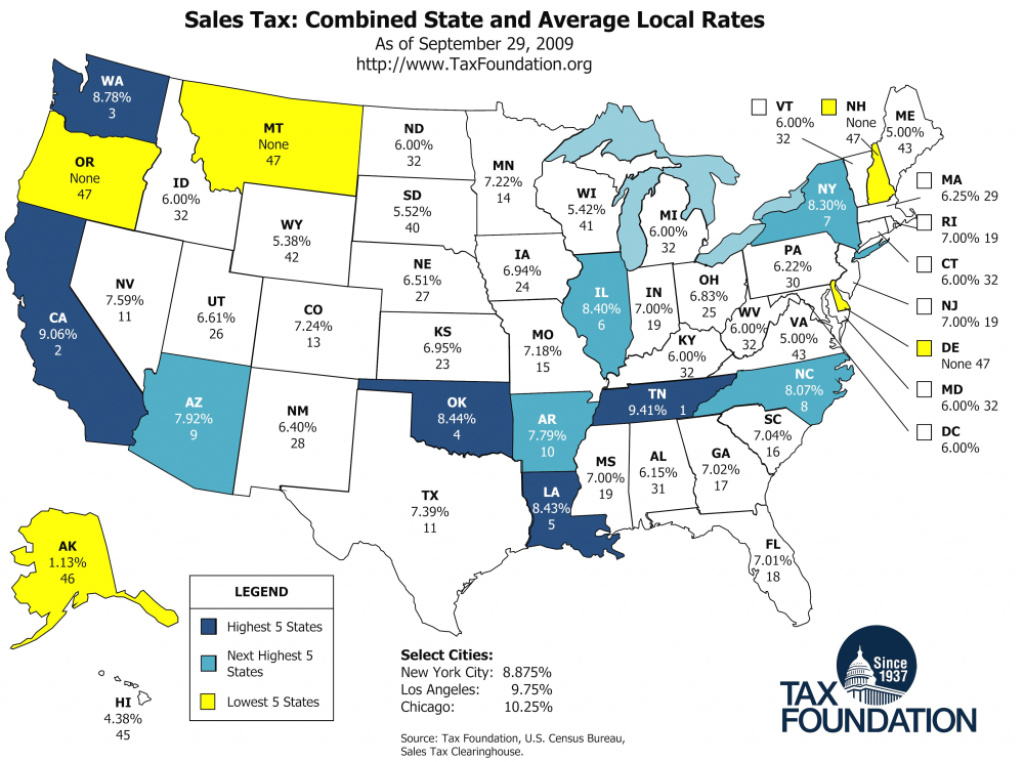

This is the total of state, county, and city sales tax rates. This figure is the sum of the rates together on the state, county, city, and special levels. This figure is the sum of the rates together on the state, county, city, and special levels. The latest sales tax rate for dallas, tx. The current sales tax rate in.

Texas Sales Tax Guide for Businesses

The sales tax rate in dallas county, texas is 8.25%. 2020 rates included for use while preparing your income tax deduction. What is the current sales tax rate in dallas? The sales tax rate in dallas, texas is 8.25%. For a breakdown of rates in greater detail, please.

.png)

Dallas Sales Tax Rate 2024 Merl Stormy

The minimum combined 2025 sales tax rate for dallas, texas is 8.25%. Dallas sales tax rate is 8.25%. The local sales tax rate for dallas, tx hovers around 8.25%. This tax applies to both goods and some services. Welcome to the new sales tax rate locator.

Dallas Sales Tax Rate 2024 Merl Stormy

This is your total sales tax rate when you combine the texas state tax (6.25%), the dallas city sales tax (1.00%), and the special tax. This results from the 6.25% texas state sales tax combined with up to an additional. As of the date of september 2023, the sales tax rate in dallas, texas is 8.25%. For a breakdown of.

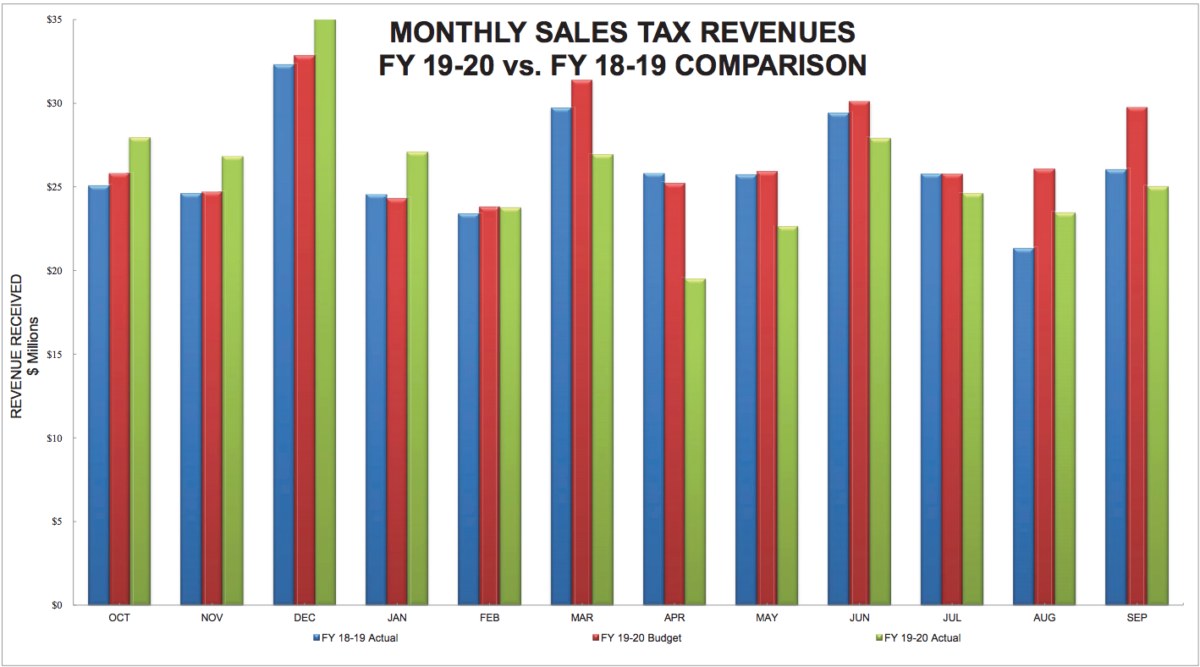

Sales Tax Revenue in Dallas Has Dropped Less Than a Percentage Point

The texas sales tax rate is currently 6.25%. This is the total of state, county, and city sales tax rates. Dallas sales tax rate is 8.25%. This rate includes any state, county, city, and local sales taxes. This is your total sales tax rate when you combine the texas state tax (6.25%), the dallas city sales tax (1.00%), and the.

State Sales Tax State Sales Tax Rate For Texas

Dallas sales tax rate is 8.25%. The latest sales tax rate for dallas, tx. The sales tax rate in dallas county, texas is 8.25%. This figure is the sum of the rates together on the state, county, city, and special levels. The local sales tax rate for dallas, tx hovers around 8.25%.

Dallas Sales Tax Rate 2024 Merl Stormy

The sales tax rate in dallas county, texas is 8.25%. The combined sales tax rate for dallas, texas is 8.25%. The texas sales tax rate is currently 6.25%. While many other states allow counties and other localities to collect a local option sales tax, texas does not. The latest sales tax rate for dallas, tx.

Sales Tax Rate Texas 2024 Karee Marjory

This is your total sales tax rate when you combine the texas state tax (6.25%), the dallas city sales tax (1.00%), and the special tax. For a breakdown of rates in greater detail, please refer. This rate includes any state, county, city, and local sales taxes. While many other states allow counties and other localities to collect a local option.

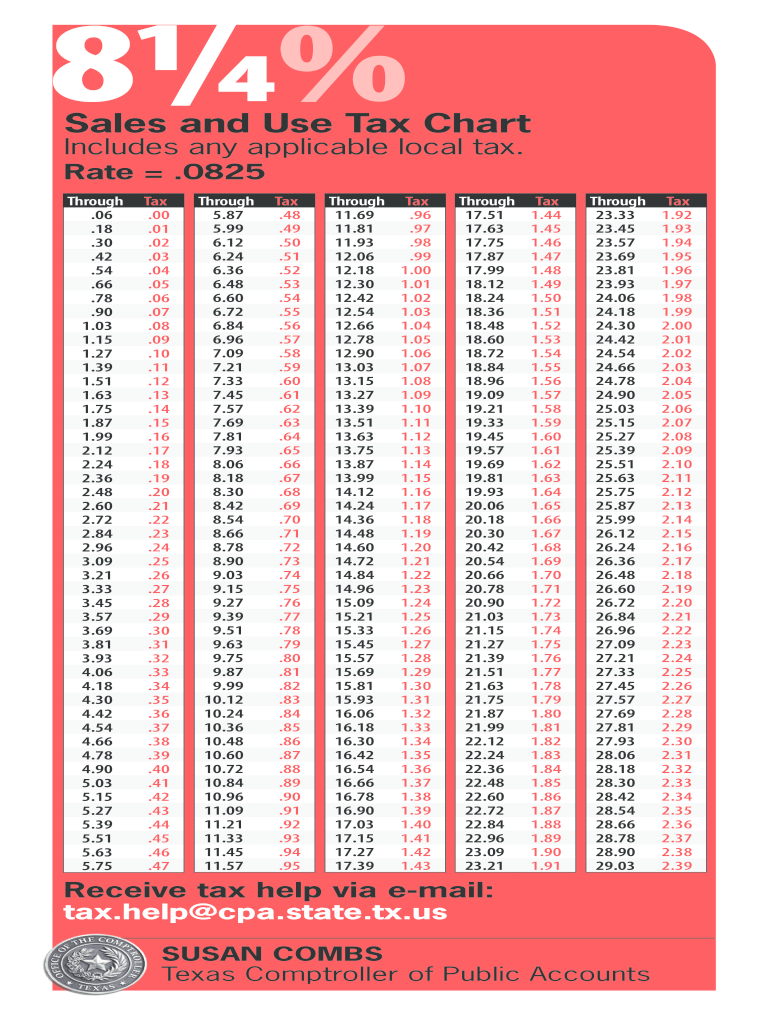

Sales Tax Rate Sheet Texas Form Fill Out and Sign Printable PDF

The sales tax rate in dallas county, texas is 8.25%. The dallas, texas sales tax is 6.25%, the same as the texas state sales tax. What is the sales tax rate in dallas texas? The sales tax rate in dallas, texas is 8.25%. For a breakdown of rates in greater detail, please.

Texas Sales Tax Chart

Dallas sales tax rate is 8.25%. The minimum combined 2025 sales tax rate for dallas, texas is 8.25%. What is the sales tax rate in dallas texas? This rate includes the state sales tax rate of 6.25%, as well as. For a breakdown of rates in greater detail, please refer.

Art, music, literature — these expressions of human creativity and emotion are not always bound by the rules of commerce. One of the most popular categories of second-hand goods for sale is clothing. When someone talks about purchasing quality goods, they are likely thinking of items that have been designed to last, to provide a superior experience, and to offer a sense of value far beyond the initial cost. Many second-hand clothing stores and online platforms specialize in curating high-quality, gently used apparel, making it easy for consumers to find fashionable items that align with their tastes. Take, for example, a high-quality piece of furniture — a well-crafted sofa or dining table can last for decades if maintained properly. The possibilities are endless, and the result is often something more unique and personal than what could be bought new. In conclusion, the market for second-hand goods for sale is an ever-growing and dynamic space that offers numerous benefits to both buyers and sellers. For the buyer, purchasing a home is a dream realized, a step toward security and stability. Used bookstores, both physical and online, offer an extensive selection of pre-owned books, from contemporary novels to classic literature. We start to treat people as commodities, too — as means to an end, as tools for achieving personal success or social status. The practice of buying and selling second-hand items has been around for centuries, but in recent years, it has seen a resurgence. The idea of being “for sale” also touches on larger cultural and societal themes. For the seller, the goal is to achieve the highest price possible for the business, while for the buyer, the goal is often to secure a fair price that reflects the true value of the business. Workers are often paid meager wages for their labor, while corporations amass wealth. The sale and purchase of second-hand goods play a pivotal role in this transition, demonstrating how individuals can make a meaningful impact through everyday choices. When we begin to view everything through the lens of commerce, it’s easy to lose sight of the things that make life worth living — the moments that aren’t for sale, the experiences that can’t be bought. There’s a certain art to selling something. They also have access to networks of potential buyers and sellers, which can help expedite the sale process and increase the chances of a successful transaction. Whether through local thrift stores, online marketplaces, or garage sales, the option to buy pre-owned items has created a flourishing market that continues to grow. For those considering buying a business, the appeal often lies in the opportunity to take over an existing operation and build upon its foundation.

The idea that everything has a price, and that everything is for sale, may seem like a grim outlook, but it’s one that has become increasingly true. This revival can be attributed to a combination of economic factors, growing awareness of environmental issues, and a shift in consumer attitudes toward sustainability and the value of pre-owned items. Even in a marketplace where everything is commodified, there is still room for those moments and experiences that transcend value. But what about the intangible things? Can memories be bought? Can feelings, emotions, or connections be traded? In a sense, many people would argue that in today’s world, even the intangible is up for grabs. This is particularly evident in industries such as furniture, clothing, and electronics. For buyers, the process typically starts with identifying a business that aligns with their interests, skills, and goals. In times of financial hardship, such as during recessions or periods of high unemployment, more people may turn to second-hand goods as a way to save money. The ease and convenience of online sales have created a global marketplace where individuals can connect with buyers and sellers across the world. A high-quality winter coat, for example, will keep you warm and dry through years of cold weather, offering comfort and protection that a cheaper, mass-produced coat cannot match. Many everyday products, such as kitchenware, footwear, and tools, can also be considered quality goods, provided they are made to last and perform well over time. The production of new goods often requires significant resources, such as raw materials, energy, and labor, while also generating waste and contributing to pollution. When an item is marked as “for sale,” it enters a space where value is defined not only by the object itself but by the context in which it’s placed. For those who enjoy the tactile experience of shopping and the sense of discovery that comes with it, thrift stores offer a personal and immersive way to shop for second-hand items. For sale, it seems like a simple phrase, yet it carries with it an array of possibilities, emotions, and decisions that can shape someone’s life. The most obvious benefit is the cost savings. Their inherent value comes not only from their physical characteristics but also from the values of durability and sustainability. People are not just looking for things that work well; they want products that elevate their environment and their experiences. The perceived high cost of these items has led some to opt for cheaper alternatives. This practice is an essential aspect of sustainability, as it helps conserve resources and reduces the amount of waste sent to landfills. In conclusion, quality goods for sale represent the best that craftsmanship, design, and functionality have to offer.