Sales Tax For Inglewood Ca – It is also important to check the seller’s reputation and read reviews or feedback from previous buyers. Perhaps the most troubling aspect of the idea that everything is for sale is how it can shape the way we view the world and each other. Whether you’re the seller or the buyer, the phrase “for sale” is a reminder that everything in life is in constant motion, always moving toward something new, something different, something better. When people buy second-hand items, they are extending the life cycle of those goods, which means fewer products end up in the trash. For those who are passionate about antiques, art, and memorabilia, the second-hand market offers endless possibilities for finding unique and valuable items that can be passed down through generations or added to a collection. In a sense, the very nature of human existence can feel like a transaction. From the most trivial items in a dollar store to the most precious works of art in a museum, everything can be assigned a price. Additionally, brick-and-mortar thrift stores and consignment shops provide a more traditional avenue for selling second-hand goods. Some businesses are sold because the owner is ready to retire, while others might be sold due to financial difficulties or changes in the owner’s personal or professional life. But even as we wrestle with the implications of living in a world where everything is for sale, we also see that this reality is not entirely negative. There is also a growing trend of upcycling and repurposing second-hand goods, where items that may no longer serve their original purpose are transformed into something new and useful. The desire for more, the constant pursuit of bigger profits and greater influence, can lead to exploitation. For sale, it seems like a simple phrase, yet it carries with it an array of possibilities, emotions, and decisions that can shape someone’s life. When consumers buy these goods, they are investing in both the product and the people behind it. These concepts, they say, are too sacred, too important to be reduced to mere transactions. The car represents possibility, and when it changes hands, it takes on new significance, a new role in a different life. Historically, many products were made by local craftsmen, and there was a direct relationship between the creator and the consumer. This sense of history and individuality is part of what makes second-hand shopping so appealing. In conclusion, the sale of a business is a complex process that involves numerous steps, from identifying the right buyer or seller to completing due diligence and negotiating the terms of the transaction. For many, owning a quality product means owning a piece of history, a connection to something larger than themselves.

California Sales Tax Calculator 2024

The 10% sales tax rate in inglewood consists of 6% california state sales tax, 0.25% los angeles county sales tax, 0.5% inglewood tax and 3.25% special tax. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. This is the total of state, county, and city.

California Sales Tax Guide for Businesses

Inglewood sales tax rate is 10.00%. You can print a 10% sales tax. 2020 rates included for use while preparing your income tax. Please note, unincorporated cities and communities are not listed below. Look up the current sales and use tax rate by address.

California Sales Tax Calculator 2024 Dorthy Evangelia

The inglewood sales tax calculator allows you to calculate the cost of a product(s) or service(s) in inglewood, california inclusive or exclusive of sales tax. Easily look up rates and estimate sales tax for inglewood, california with our best in class calculator. The inglewood, california sales tax is 10.00%, consisting of 6.00% california state sales tax and 4.00% inglewood local.

Sales Taxstate Here's How Much You're Really Paying California Sales

2020 rates included for use while preparing your income tax. The california sales tax rate is currently 6.0%. Zip code 90303 is located in inglewood, california. Inglewood sales tax rate is 10.00%. Sales tax calculator of 90313, inglewood for 2024.

How to Calculate California Sales Tax 11 Steps (with Pictures)

The 90303, inglewood, california, general sales tax rate is 10.25%. Sales tax calculator of 90313, inglewood for 2024. Your total sales tax rate is the sum of the california state tax (6.25%), the los angeles county sales tax (1.00%), and the. Easily look up rates and estimate sales tax for inglewood, california with our best in class calculator. The 90301,.

California Sales Tax 2024 Calculator With Taxes Betsy Collette

The minimum combined 2025 sales tax rate for 90302, california is 10.0%. The combined sales tax rate for inglewood, california is 10.00%. The current sales tax rate in 90043, ca is 10%. Inglewood sales tax rate is 10.00%. The 10% sales tax rate in inglewood consists of 6% california state sales tax, 0.25% los angeles county sales tax, 0.5% inglewood.

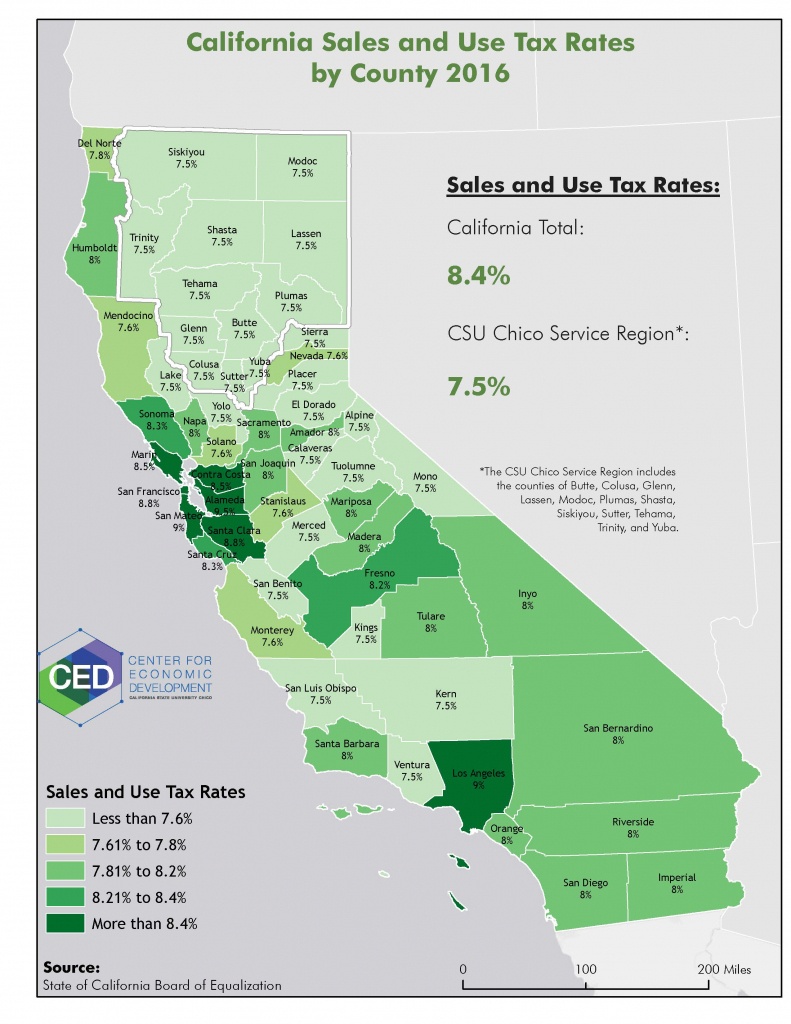

Understanding California’s Sales Tax

The 90301, inglewood, california, general sales tax rate is 10%. Your total sales tax rate is the sum of the california state tax (6.25%), the los angeles county sales tax (1.00%), and the. 286 inglewood street, winnipeg, manitoba r3j1w9. The 10% sales tax rate in inglewood consists of 6% california state sales tax, 0.25% los angeles county sales tax, 0.5%.

Orange County Ca Sales Tax Rate 2024

The latest sales tax rate for inglewood, ca. The current sales tax rate in 90043, ca is 10%. Inglewood sales tax rate is 10.00%. The 2025 sales tax rate in inglewood is 10.25%, and consists of 6% california state sales tax, 0.25% los angeles county sales tax,. The california sales tax rate is currently 6.0%.

California Sales Tax Map Printable Maps

The minimum combined 2025 sales tax rate for 90302, california is 10.0%. The combined rate used in this calculator (10.25%) is the result of the california state rate (6%), the 90304's county rate. 2020 rates included for use while preparing your income tax. The 2025 sales tax rate in inglewood is 10.25%, and consists of 6% california state sales tax,.

California Sales Tax All You Need to Know Tax Law Advocates

The latest sales tax rate for inglewood, ca. The combined rate used in this calculator (10.25%) is the result of the california state rate (6%), the 90303's county rate. The inglewood, california sales tax is 10.00%, consisting of 6.00% california state sales tax and 4.00% inglewood local sales taxes.the local sales tax consists of a 0.25% county sales tax, a..

Whether it’s a handmade leather bag, a vintage watch, or a luxury car, the term “quality” brings with it an expectation — an assurance that the item in question has been crafted with care, attention to detail, and materials that can stand the test of time. Acquiring an established business can provide a head start in terms of customer relationships, operational systems, and brand recognition. In conclusion, the market for second-hand goods for sale is an ever-growing and dynamic space that offers numerous benefits to both buyers and sellers. This practice is an essential aspect of sustainability, as it helps conserve resources and reduces the amount of waste sent to landfills. The rise of minimalism and a desire for unique, vintage items has also played a role in the growing popularity of second-hand goods. They also often help with legal and financial aspects, ensuring that the transaction is completed smoothly and efficiently. Another key benefit of second-hand goods is their positive impact on the environment. This is particularly evident in industries such as furniture, clothing, and electronics. The longer something is used, the less likely it is to contribute to the growing problem of waste. These goods aren’t just products; they are symbols of craftsmanship, heritage, and pride. Relationships can become transactional, where each party enters into an agreement based on what they stand to gain. These professionals help connect buyers with sellers, ensuring that both parties are well-informed and that the transaction process is as smooth as possible. In some cases, buyers may also acquire businesses with existing intellectual property, such as patents, trademarks, or proprietary technologies, which can offer a competitive edge in the market. Used bookstores, both physical and online, offer an extensive selection of pre-owned books, from contemporary novels to classic literature. A high-quality winter coat, for example, will keep you warm and dry through years of cold weather, offering comfort and protection that a cheaper, mass-produced coat cannot match. It’s a world where even personal growth, self-actualization, and emotional healing are framed as commodities, available for purchase at any time, but only if you’re willing to pay the price. Thrift stores, consignment shops, and online marketplaces like eBay and Poshmark provide a platform for people to sell or buy pre-owned high-quality goods. While there are certainly markets where affordable goods are a necessity, quality goods for sale often come with a premium price tag. For example, an old wooden chair might be sanded down and refinished into a modern piece of furniture, or a vintage dress might be altered to fit a contemporary style. A car might be sold because it no longer serves the needs of its owner, or perhaps the owner is simply ready for a change.

It’s a moment of transition, and as with all transitions, it brings with it both excitement and uncertainty. The idea of buying things that were once owned by someone else is no longer considered taboo or lesser; rather, it has become a lifestyle choice for those who want to make smarter, more ethical purchasing decisions. In the age of immediacy, it can often feel as though many goods are made with built-in obsolescence, created to be replaced every few years. But in reality, even the most profound relationships can be commodified in some way. The promise of success in a marketplace driven by capitalism can be an illusion for those who don’t have the resources or opportunities to compete on equal footing. People are not just looking for things that work well; they want products that elevate their environment and their experiences. These concepts, they say, are too sacred, too important to be reduced to mere transactions. Additionally, there is the challenge of integrating the business into their existing operations and ensuring that it continues to thrive under new ownership. Economic downturns, for example, can influence the types of businesses that are put up for sale, as struggling companies may look to exit the market. After the sale is complete, the buyer assumes responsibility for the business and takes control of its day-to-day operations. In some cases, it’s not just objects that are for sale, but entire industries or institutions. For when everything is for sale, it’s easy to forget that the most important things in life are not commodities; they are experiences, relationships, and moments of connection that cannot be measured in dollars and cents. As society has evolved, the scale of production has expanded, and many quality goods are now mass-produced or distributed through large retail chains. In this world, emotions can feel like products, available to be consumed at will and disposed of when they no longer serve a purpose. Sometimes, a sale can feel like the closing of one chapter and the opening of another. The world of second-hand goods for sale is vast and varied, encompassing everything from clothing, electronics, and furniture, to books, antiques, and collectibles. For those on a budget or looking to stretch their money further, second-hand markets provide an opportunity to purchase goods that would otherwise be out of reach. A business for sale is not always as it appears on the surface, and the buyer must examine the company’s financial statements, contracts, debts, and even its customer relationships before deciding whether to proceed with the transaction. The object becomes more than just an object – it transforms into a transaction, an exchange of value. This connection between consumers and the creators of quality goods is something that’s been fostered for centuries.